The Secret to Unlocking Hidden Value: Sourcing

Understanding a supplier's over-cost is not just a strategic advantage: It's an essential practice for jewelry retail CFOs.

Executive Summary

- Understanding a supplier's cost structure is not just a strategic advantage: It's an essential practice for jewelry retail CFOs

- With companies facing more pressure than ever to deliver savings, procurement teams can offer not only short-term relief, but also long-term rewards

- Drive corporate performance through data-enabled costing negotiations, leveraging market benchmarking and component costing

- Own the data to make cost avoidance an enduring win

- Leverage cloud solutions that drive finance function transformation for years to come

.png?width=778&name=CFO%20Marketing%20article%20-%20loupe%20esc%20negotiations%20timeline%20(1).png)

As economic uncertainty continues, CFOs face complex and contradictory demands as they strive to drive long-term value and find short-term cost efficiencies while re-inventing the finance function. However they continue to be integral leaders in their organizations’ transformation for long-term competitiveness and need to make bolder changes to deliver lasting transformation.

As CFOs look to build digitized finance functions to drive sustainable, long-term growth, their top priorities are transforming finance technology and advanced data analytics. These two areas topped the list of CFO transformation priorities, with technology transformation in top place (selected by 37%) and advanced data analytics selected by 27%, according to CFO Survey by PwC 2022 (i)

Insight into the gritty details of what creates value and cost, probing fixed and variable costs is essential to revealing what matters most to the business’ operating leverage. However CFOs biggest constraint often stems from a lack of IT systems resulting in isolated business units which limits access to this critical data. Inertia is often cited as the main constraint against delivering a CFOs digital transformation agenda.

Finding relief can often be found in an unexpected place: the sourcing organization. The benefits of investing in these long-term strategies are substantial. According to McKinsey benchmarking, “research shows a 99% correlation between dedicated efforts in capability building and improved procurement outcomes”.

By addressing this often overlooked source of value and re-evaluating strategies for sourcing efforts such as by implementing digital solutions, companies can quickly achieve substantial efficiencies through cost savings and cost avoidance across almost all purchasing.

(i) CFO Insights from the PwC Pulse Survey 2022, https://www.pwc.com/us/en/library/pulse-survey/executive-views-2022/cfo.html

(ii) "Now is the time for procurement to lead value capture", McKinsey, Feb 25 2021

Understanding a supplier's component costs is not just a strategic advantage: It's an essential practice for jewelry retail CFOs seeking to optimize procurement and enhance profitability

Sourcing negotiations lie at the heart of cost management for jewelry retailers. Understanding a supplier's costs goes beyond surface-level negotiations. CFOs need to equip themselves with the insights necessary to ensure the team has the appropriate tools to navigate negotiations in a competitive jewelry retail landscape.

To gain a strong negotiating position, CFOs and their sourcing teams must dive deep into understanding their supplier's component costs. This knowledge is a powerful lever that can drive favorable terms, cost reductions, and enhanced profitability. 53% of CFOs say they plan to accelerate digital transformation using data analytics, AI, automation and cloud solutions - PwC Pulse Survey, August 2022

It involves a comprehensive analysis of cost drivers, market dynamics, and industry benchmarks. Armed with this information, CFOs can engage in negotiations with confidence, knowing where cost-saving opportunities exist and how to leverage them effectively.

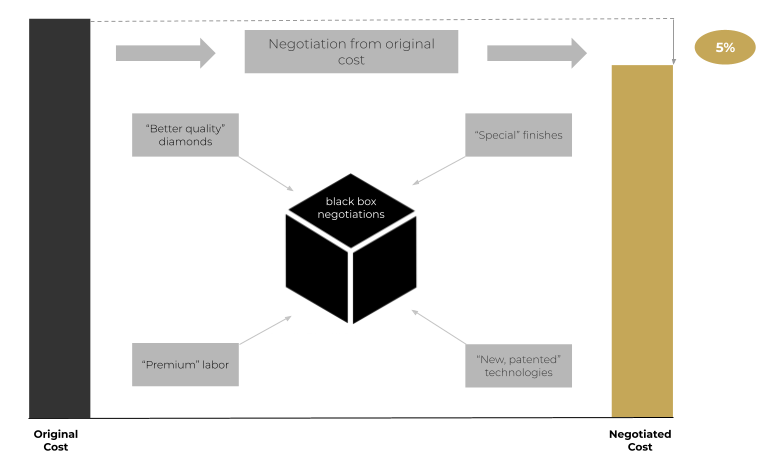

Traditional Tools Restrict Negotiation Power

Traditional negotiation methods have their limitations, often leaving substantial cost-saving opportunities untapped. Good data is rarely readily available. CFOs are often hampered by data tracking capabilities in order to capture value-adding opportunities for their businesses. CFOsChief Financial Officers (CFOs) in the jewelry retail industry need to recognize these limitations and explore innovative approaches to negotiations that can unlock hidden efficiencies.

CFOs should consider incorporating advanced negotiation tools to gain a competitive edge. These tools can provide real-time data analysis, helping to identify areas for optimization, renegotiation of contracts, and the negotiation of more favorable terms. Identifying lower-cost technologies which can maximize the benefits of negotiations in weeks and months rather than years is key to driving value creation - and quickly.

Supply Chain Cost Transparency presents unprecedented value creation opportunities - in weeks

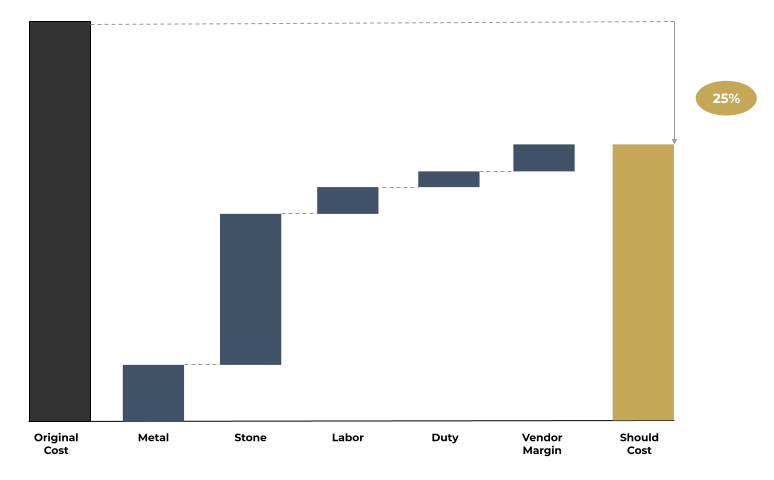

Transparency plays a key role in cost management for jewelry retailers. Should-cost analysis is an effective tool that highlights the value of transparency by aiding companies in determining the appropriate costs of their suppliers, guided by market standards and the costs of components.

Should-cost analysis helps organizations compare their actual costs with what they should be paying for materials, labor, and other components. This analysis highlights any discrepancies and enables jewelry retailers to negotiate better deals based on accurate cost data.

Moreover, the benefits of transparency extend beyond immediate financial gains. It cultivates trust and strengthens ties with suppliers. Suppliers value this openness as it encourages frank and honest dialogue. Consequently, this can evolve into more cooperative relationships and ongoing cost efficiencies.

Implementing transparency via should-cost analysis is invaluable for jewelry retailers. It not only uncovers potential savings but also bolsters supplier partnerships, proving to be a pivotal aspect of effective cost management strategies.

Retail Case Study: Signet Group

"One final example of how we're leveraging data is the way we're driving out product costs without compromising quality and innovation. A recent example is a sourcing technology that we've activated, which we call Loupe. This is a leading sourcing system that allows us to benchmark standardized component costs, establish should-cost pricing models, and create transparency and cost negotiations across our network, lowering costs and matching product demand and supply needs with the right vendors across all our banners.

We're early in our implementation, but already in Q1, we estimate that we avoided mid-single-digit cost increases to loose stones. Based on our early success, we are now doubling our expectation of savings from $20 million to $40 million this year and believe we can ultimately save up to $200 million annually over time. This level of cost transparency gives us a clear competitive advantage, particularly with current macro headwinds. The point of these examples is to underscore that the investments we've made and continue to make to strengthen critical capabilities and create competitive advantages are working."

Gina Drosos, CEO of Signet

Signet FY24 Q1 Earnings Call Transcript (NYSE: SIG)

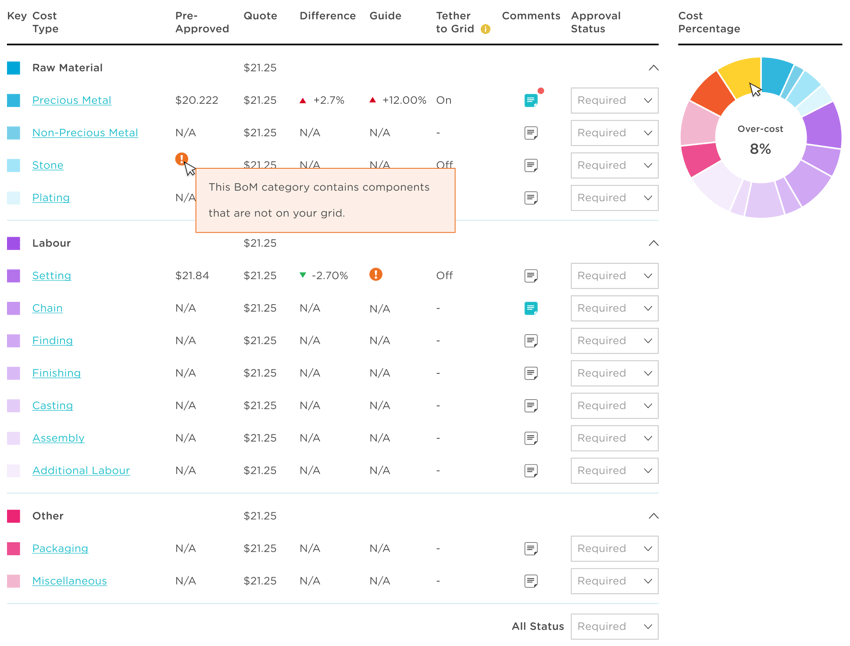

CFO Agenda: Own the data to make cost avoidance an enduring win

Maintaining the financial robustness of your jewelry retail business extends beyond short-term cost reductions. It's vital to embrace a culture of ongoing cost management. For CFOs, cost optimization should be seen as a continuous journey, not just a one-off initiative.

.png)

This method involves regularly reassessing your supply chain relationships, reviewing contractual agreements, and monitoring market trends such as diamond volatility. In the face of this increasing uncertainty, it’s essential for your organization to remain agile and adaptable, adjusting your tactics as needed to maintain competitiveness and financial strength.

.png)

This method involves regularly reassessing your supply chain relationships, reviewing contractual agreements, and monitoring market trends such as diamond volatility. In the face of this increasing uncertainty, it’s essential for your organization to remain agile and adaptable, adjusting your tactics as needed to maintain competitiveness and financial strength.

Implementing a strategy of persistent cost management can create lasting benefits for your jewelry retail business.

Even in a relatively short period of time, a public or privately owned company CFO can make targeted investments in both cost-reducing and productivity-enhancing tools such as an off-the-shelf, cloud-based sourcing and order management software which can achieve the following:

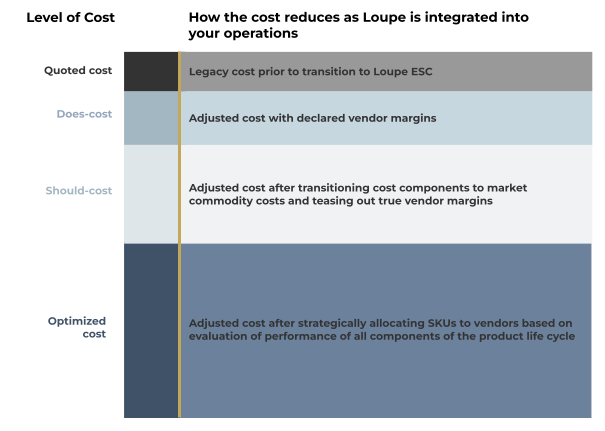

- Identify how the solution will deliver high-value, quick wins in the near term, moving from quoted to does-cost

- Allowing these smaller initial successes to compound while also engaging in medium-term projects such as deploying strategies to drive towards should-cost or could-cost with your suppliers - delivering returns starting within weeks

- Use pairing indicators of should-cost analysis vs quality control rates to ensure increased cost efficiencies are not delivered at the expense of quality which can easily offset negotiated gains

Target State

Here is an example of the type of conversation CFOs or Sourcing Managers can have with vendors at the end of a trading period once armed with Should-Cost tooling:

"We've had a good year, total production value ended at $7.3m which places you at #11 in our supply chain when sorted by production-value. We can commit to 20% increase in your production value next year if your gross over-cost is reduced from 20% to 18.5%"

This forward-thinking mindset and transparent way of working leads to increased trust between trading partners and greater collaboration.

Powered by cloud-sourcing software, CFOs and finance functions can take control of their supply chains to a new level, securing immediate benefits & paving the way for sustained financial health and success in the jewelry retail industry.

Partner with people who see the same future as you

If the ideas in this article resonate with you and you would like us to review your technology stack & modernization strategy free of charge, we are always delighted to engage, share our insights, and learn from yours.

Vishnu Hariharan CFA

is Chief Business Officer at Loupe, Based in London